Written on Nov 19, 2019 11:51:52 AM

Everything You Wanted to Know About Auto Insurance

Topics: auto accident, personal injury

The road can be a very dangerous place; in fact, there are approximately six million auto accidents every year. It also doesn’t help that nearly one in eight U.S. motorists are driving around uninsured, putting insured drivers at greater risk in the event of an auto accident. Why do some drivers forgo auto insurance? Often, it comes down to expense. Auto insurance isn’t cheap, and there’s a reason: road crashes cost the United States over $230 billion per year—and car insurance claims cost companies several billion dollars every year as a result. If you have auto insurance, you may be wondering how the claim process works.

Auto Insurance Investigations

Insurance companies follow a strict investigation process to ensure that claims are not fraudulent (individual insurance fraud and organized insurance fraud schemes cost companies billions, according to the Insurance Research Council). This results in consumers paying an extra $200 to $300 per year in premiums to offset the costs. So how does the auto insurance claim investigation process work? There are a few factors that determine the process:

- The nature and severity of the accident

- Your insurance company’s policy

- Whether the accident involved property damage, injuries, or death

If you’ve been seriously injured, you should consider legal support. For less severe crashes, you can expect the following when it comes to insurance claims.

Assignment of Claims Adjuster

Once your claim is filed, your case will be assigned to a claims adjuster who works for the insurance agency. Their job is to go over your policy, confirm your coverage, and ask you questions about the incident (they’ll be looking for holes in your story, so that’s why it’s always a good idea to jot down details immediately following the accident it while the details are fresh in your memory). They are also likely to do the following:

- Contact other drivers involved as well as witnesses

- Inspect your vehicle and take photographs of damages

- Visit the scene of the accident

- Request a copy of the police report

- Contact your medical provider if you sustain injuries

Determination of Fault

Because fault is not determined by liability laws, it’s up to insurance companies to decide your eligibility and how much money you’ll receive. Oftentimes, there is an allocation of fault—for example, Florida follows the Florida Comparative Fault Statute. Under this statute, parties are allowed to recoup damages even if they are partly to blame for the accident; however, the amount they receive will be offset by their degree of fault. All the details compiled by the claims adjuster will help to determine fault.

Vehicle Reimbursement & Payment

Once fault has been determined, your insurance company will cover vehicle repair through a process called indemnification (if the other driver is to blame, they will seek payment from his or her insurance company through the subrogation process; if they are uninsured and you carry uninsured motorist (UM) coverage, you’ll be paid and your insurance company will pursue the other driver to recoup the money).

Generally, your insurance agency will give you a number of vehicle repair options:

- Use a company-approved body shop to have the costs fully covered

- Use your own body shop understanding you may have to pay the difference if costs go above the insurance company’s estimate

- Get quotes from several body shops and they will select one for you

Medical Reimbursement & Payment

Claims including medical expenses resulting from an accident will require evidence of medical bills. You may also need to give your insurance company permission to access medical records through a waiver. Because of the complications involved in accident injuries, and to be sure you’re being compensated properly, you should also consider speaking with a personal injury attorney who can review your case.

A final word of caution: watch yourself on social media. You’re under investigation, after all, and insurance companies don’t want to pay you unless they have to. If you post something on social media that damages your case and they see it, you can be sure they’ll use it against you.

Understanding Your Auto Insurance Policy

Now that you have a better understanding of the claims process, you may want a better understanding of your own auto insurance policy. Time and time again, people get into accidents and realize they don’t have the coverage they thought they did. To understand what coverage you have, you need to review your policy closely.

The Declarations Page

If you want to know specifics on the number of coverages you have, a summary is located in your policy’s Declarations Page. This also provides the basic information about the insured’s name, how long the coverage applies, and all other deductibles and premiums (premiums are how much your select coverage costs).

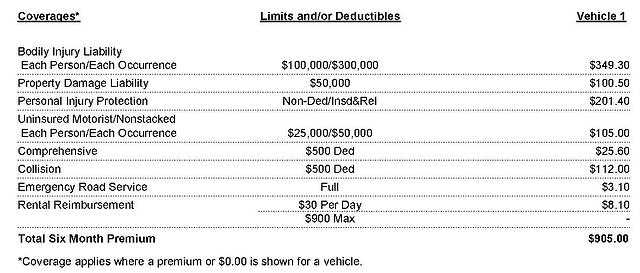

Here is an example of the coverages section of a declarations page for a Florida insurance policy:

This is the part you want to pay attention to (of course, you want to verify that your address, insured vehicle, and policy number are all correct as well). The first column describes the type of coverage you are opting to have, the second shows limits and/or deductibles, and the third column shows your insured vehicle and the premium for that coverage.

Why Are There Two Numbers for My Limits?

Common questions when overlooking an auto insurance policy may be: why does it say $100,000/$300,000, or $25,000/$50,000? This should be read as per person, per accident. It is listed on the image as each person and each occurrence. For example, a single person involved in an accident in Florida may be able to recover a maximum of up to $100,000 or $25,000. However, when multiple people are involved in an accident, the greater numbers come into play ($300,000 or $50,000). When there are two or more people in your vehicle at the time of the accident, between all of you, you are covered up to $300,000 or $50,000 (or whatever that second number is on your own policy).

Keep in mind, this depends on the amount of injury for each person, and doesn’t mean you’re guaranteed that amount of compensation. In fact, the breakdown of how much you are entitled to depends entirely on circumstances and your injuries. This may not be a perfectly round number, and may not be evenly distributed between everyone.

Deductibles

Not all coverages have these two numbers, as the conditions do not always apply. Property damage (PD) is only one number, simply because that is the amount of damages you cover if you are ever in an accident with another driver or other property (such as a house or fence). PD is divided into comprehensive coverage (such as a loss due to theft or flood) and collision coverage (such as an accident with another car or property).

PD has deductibles, which means you pay an initial fee up-front to cover the costs of an accident or loss. Typically, the higher the deductible, the lower the premium. If you have a 0% deductible or no deductible, your insurance company will cover all the costs to repair your vehicle (but this means your premium will be very high).

In our example above, with a $500 deductible, you would be responsible for the first $500 dollars to cover injuries or damage, and the insurance company would cover the rest.

Personal Injury Protection (PIP) can also have a deductible (although in the case above, it does not). Deductibles work similarly with PIP, except how it is applied is slightly different. Since PIP covers 80% of all medical bills in relation to the accident, with a $500 or $1,000 deductible, it is usually placed on your bill as outstanding before PIP payments are applied.

Rental

If your vehicle is ever in the shop being repaired, you are going to need a temporary replacement to get around. In the example above, the policy basically states your insurance will cover a rental vehicle up to $30 a day, for a maximum of $900. Once the rental exceeds $900, you will be responsible for further payments.

Some exceptions can be made, such as if the other insurance company involved is being negligent on repairs. In these cases, your insurance company will pursue compensation through them and not you; this is called subrogation.

Uninsured Motorist: Stacked vs. Non-Stacked

There are many intricacies to Uninsured Motorist (UM) coverage. Without going into too much detail, if you have only one vehicle you’ll want to get non-stacked coverage, because you don’t receive any additional benefit by stacking your insurance.

If you have multiple vehicles, stacked coverage is going to benefit you for a small cost: this adds to the amount you can recover, because in your claim you can collect the coverage of both your vehicles. If you only had 10/20 coverage, and one of your vehicles is in an accident, you are able to collect double (20/40).

What Makes Auto Insurance Rates Skyrocket?

Reviewing your auto insurance policy will help you understand what you may be able to recover in the event of an auto accident in Florida. Make sure that you consult with an attorney if there is something you don’t understand about your policy. Of course, you may be left wondering just why auto insurance is so costly. Aside from the statistics we mentioned at the start of this story, there are four other major factors that cause auto insurance rates to skyrocket.

A Recent Auto Accident

This reason should come at no surprise; automobile accidents, whether you are at fault or an unsuspecting victim, almost always cause auto insurance rates to skyrocket. In the event of an auto accident—especially in combination with a poor driving record—most insurance companies will instantaneously decide you are prone to roadway risks and up your coverage costs.

In many accident cases, speaking with a trained attorney in your community before calling your insurance provider can prove essential in keeping the accident’s affect on your insurance rate minimal. Never admit fault following an auto accident, and reach out to a licensed attorney in your area to minimize legally grounded adjustments to your current rate.

Points: Your Driving Record and Your Insurance

Driving is regarded as a privilege, which can be taken away as a result of repeat safety infractions, tickets, or automobile accidents. Driving violations result in points on your record, which give insurance companies legal proof of hazardous driving behaviors. The more points you have attributed to your license, the less safe insurance companies will view your driving; they will determine yourself and your automobile, as well as and others on the road when you are driving, at heightened risk, and must adjust your rate accordingly to account for this increased incident potential.

The following is a snapshot of common traffic violations, and the points they incur according to DMV.org:

- Leaving the scene of an accident with damage of at least $50: 6 points

- Speed violations resulting in an accident: 6 points

- Driving recklessly: 4 points

- Moving violations that cause an accident: 4 points

- Attempting to pass a school bus that has stopped: 4 points

- Exceeding the posted speed limit by 15 MPH or more: 4 points

- Not obeying traffic control signals or devices: 4 points

- Exceeding the posted speed limit by 15 MPH or less: 3 points

- All other moving violations not previously mentioned: 3 points

- Driving with an open container: 3 points

- Violating child restraint regulations: 3 points

- Littering: 3 points

Beyond your monthly insurance rates, exceeding state-mandated point maximums in Florida can result in a license suspension for as long as 12 months, depending on the number of points incurred and the timeframe in which they were gained.

- 12 points in 12 months: 30-day license suspension

- 18 points in 18 months; 3-month license suspension

- 24 points in 36 months; 1-year license suspension

Your Car is Poorly Equipped With Safety Features

Another reason your auto insurance rates may be significantly higher than usual is if your car no longer meets certain safety requirements, has excessive mileage, or lacks key safety features, such as air bags, anti-lock brakes, an alarm system, or daytime running lights. Without these features, which are designed to optimize your vehicle’s safety rating, your car will be considered more dangerous than similar models that include these features. These increased dangers usually result in increased auto insurance rates to cover any incident or damage that could have been avoided with these safety features.

Your Policy Includes a Minor

If your policy includes a minor automobile operator (teenage children with driving permits, or licensed children under 18 who borrow your vehicle frequently), you can expect much higher auto insurance rates to accommodate the additional risks young drivers pose. Across the United States, teen drivers are over ten times more likely to be involved in an auto accident and are accountable for 20% of all Florida accidents. If you’ve recently added a teen driver to your policy, you can expect sudden adjustment spikes on your next insurance bill. If this is the case, we recommend you research discount programs for young drivers that can help lower the added rate, such as good student discounts.

Auto Accident Injury but No Auto Insurance

So what happens when you are injured in an auto accident and the other driver does not have any auto insurance? Hopefully, you’ve purchased uninsured motorist coverage on your own policy to protect you in this situation. But should the other driver walk away without any punishment? Absolutely not! In fact, many times your own auto insurance company can go after the other driver and seek repayment. Also, if you sue the other driver and receive a judgement, the Florida Department of Highway Safety and Motor Vehicles will suspend the other driver's license for up to 20 years or until the entire judgment is satisfied. This can include trucking accidents, motorcycle accidents, and car accidents.

Have Questions or Need Help?

If you have been hurt and need an automobile accident attorney to pursue your personal injury lawsuit, contact us for support and guidance. We handle car, motorcycle, and trucking accidents throughout central Florida and are ready to go to work for you to get you the compensation you deserve. If money is a concern, don’t worry—we don’t get paid unless you do. Call today and speak directly with a personal injury attorney in your area.